While playing beach tennis on vacation, I was wondering: “How come these beach ball sets always wear out by the end of the vacation?” It struck me that these cheap pallets are a good example of fine value engineering. I get just enough value for the lowest possible price. I paid 3,00 EUR for a set that I only intended to use for a few weeks anyway.

Do the trade-off

The key to value engineering: set clear product requirements. In the case of my beach pallets, durability wasn’t ranked very high in the product requirements, as for my use case it wasn’t valued anyway. Downgrading the durability opened the possibility for the use of lower quality materials, resulting in a significant cost advantage, which was highly valued in my case.

Only by having a good understanding about my needs and what I was willing to pay for it, they managed to design a product which was in line with my expectations, i.e. low cost and no need for durability.

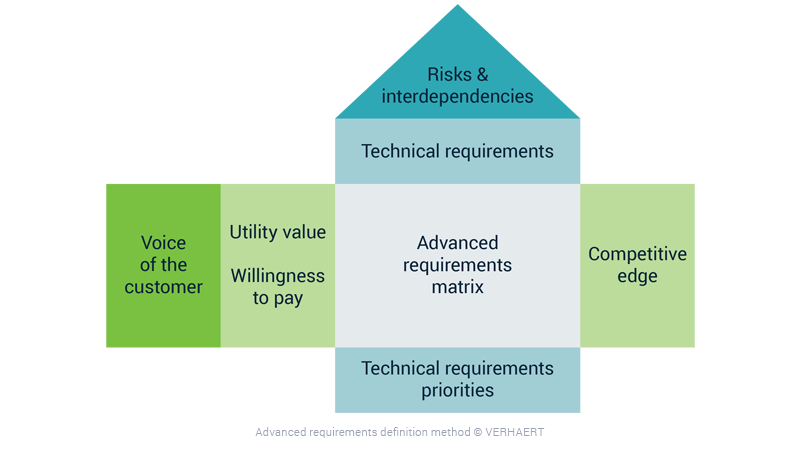

Several tools exist to make a trade-off between added value for the consumer, production costs and price setting (competitive edge) and new technologies resulting in the final product requirements. The figure below is a summary of the different aspects that need to be taken in consideration when defining the final product requirements.

Not a cost down exercise only

The aim of value engineering is to design a product that will represent the optimum value to the manufacturer and customer.

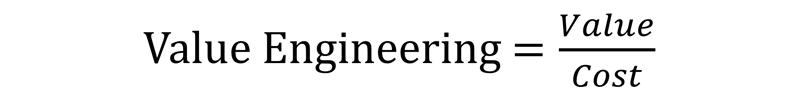

Based on the beach tennis example, value engineering might be perceived as a pure cost down exercise. It’s not, it’s about the equation between value and cost. After a value engineering excursive, the outcome of the equation should go up.

Value engineering is therefore an interesting tool to design your products and thus a strategic tool for decision making.

The CEO’s mind: “Product sales is going down in a mature market, what should I do? Shall I focus on cost in order to get higher margins in order to compensate declining sales? Or should I focus on added value in order to boost sales (but with higher costs and lower margins)?”

Value engineering and strategic decisions

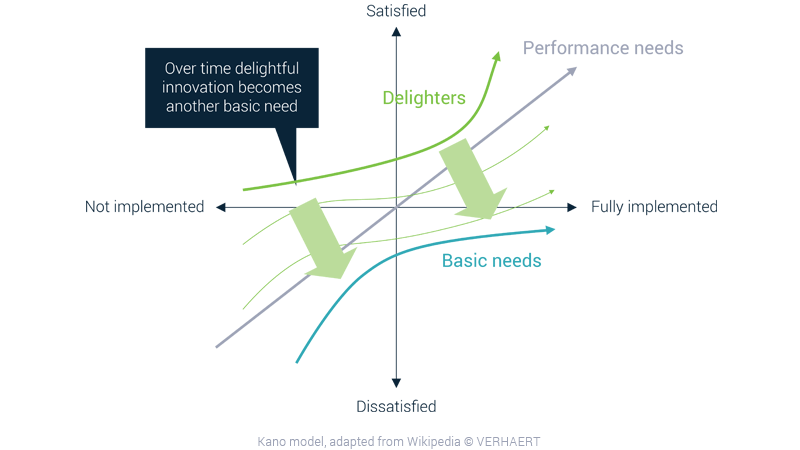

The perceived value of products go down over time, and therefore also the price people are willing to pay for it. Products that were innovative in the past, are the new normal today.

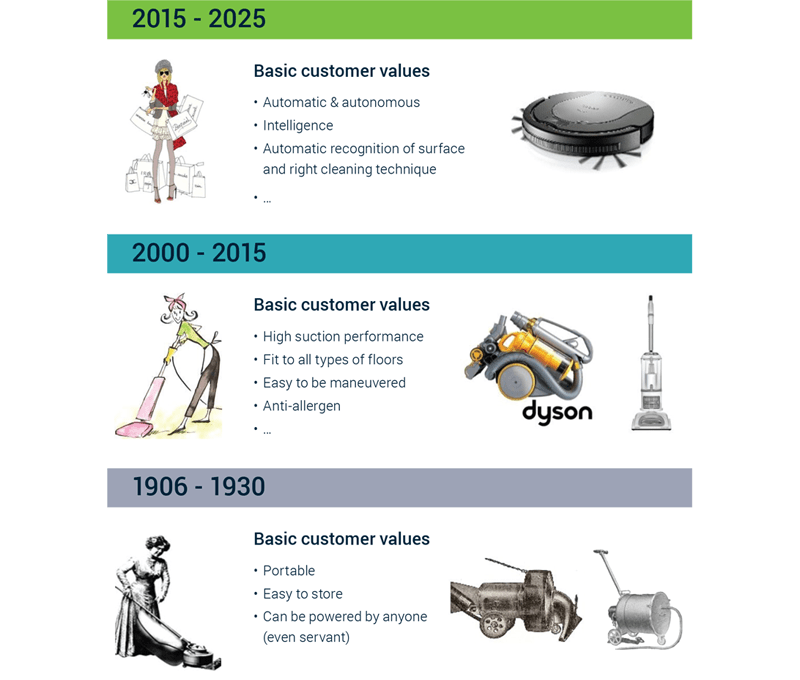

The next example shows that expectations from vacuum cleaners evolved over time, forcing companies to redesign and/or reinvent their products.

What we find interesting about the vacuum cleaners evolution is that established brands – due to new emerging technologies – are challenged and replaced by new brands. Hoover got challenged by Dyson’s bagless system, which is challenged today by new comers using sensor and AI technologies, of which the market leader is still undecided.

Over time, consumer needs and expectations evolved, as the Kano model above explained. This means that vacuum cleaners needed to reinvent themselves in order to match consumer needs. The value engineers of the challenging companies, knowingly or unknowingly, inserted new technologies into “advanced requirements definition method”, opening new possibilities for the value engineering equation, and changing the market balance. The established brands held on to the established technologies which gave themselves less options to do the value engineering exercise right.

What’s the CEO’s best strategy?

Well, there isn’t a best “1-fits-all-strategy”. The best strategy depends on your goal. If you decided to be a follower, like Samsung after the iPhone launch, then try to come close to the added value of your competitor for a lower cost. If you decide to be a challenger, then try to disrupt with new technologies and bring disruptive innovation (and added value) to the table, like the iPhone did during the Nokia reign.

There isn’t a superior product strategy (sorry).

Choose wisely

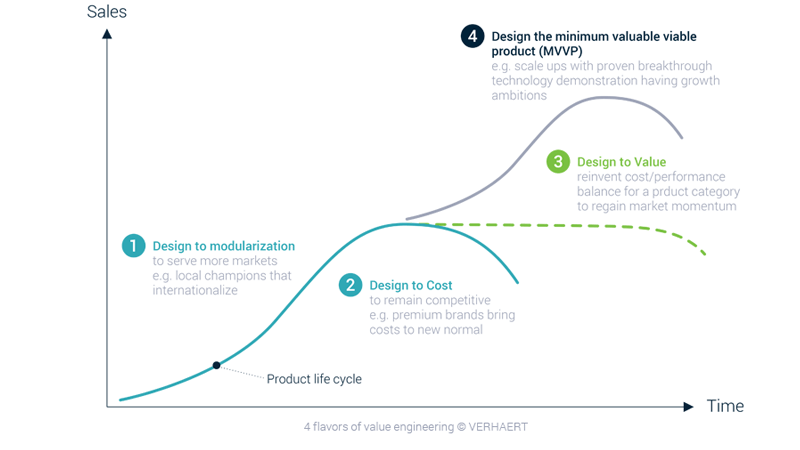

The CEO in the example above can choose out of 4 flavors of Value Engineering for his strategy:

- Invest and expand: develop a modular platform to have international economies of scale.

- The cash cow: design to cost of products to the new normal.

- Design to value: beating commodity for existing mature markets.

- The challenger: define the Minimum Valuable Viable Product for new markets.

Invest and expand: design to modularization

While originating from the car manufacturing industry, modularization can be applied wherever complex systems have to be managed and have already been successfully transferred to branches such as logistics and IT.

Modularization facilitates the standardization of product components (cost down) while still allowing variety in the product design in order to adapt to local markets, resulting in higher perceived value in the local market.

Is this the right strategy though? If you are present in different markets or market segments, if you are willing to invest in modularization, and you have a technology that can be tailored

to these markets, then this might be your way to go.

The cash cow: design to cost

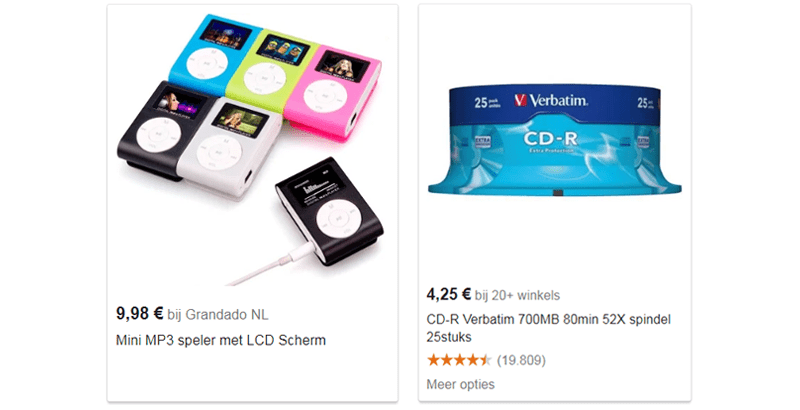

If you are the product manager of the company’s cash cow, then this might be an interesting strategy. The value of the product goes down over time as the perceived value dilutes (see Kano model above). Therefore sales goes down which can be compensated by cost reductions of the product. Good examples are CD’s and mp3 players, which became cheaper over time and thus extended the revenue they created. This is the so called race to the bottom, where the one with the lowest cost takes the market.

Design to value: beating commodity

This is an interesting approach when your product is in a commoditised market. If there is a lot of competition and you want to avoid the cost race to the bottom, then you might reconsider the performance/cost equation.

This can be done by adding or removing features to a product. The Draftmark drafting system is an example where we removed certain features in order to focus on the core of the product: serve fresh beer. In this system we removed the most expensive and complex part: the cooling. We designed the product in such a way that it fits in a home fridge resulting in a retail price of only 49 dollar.

You could also review the complete value/cost equation by lowering the added value for the consumer in combination with a drastic price reduction, like Renault did with Dacia. Dacia uses Renault technologies and components of previous generation cars, and thus with lower perceived value for the consumer. Over time these technologies have been fully fine-tuned and the investments have been fully amortized, resulting in reliable low cost components.

The challenger: design the MVVP

You have found a solution for a hidden need, and you have developed a new technology, then you might conquer the market with your breakthrough product.

This is a different category as it isn’t a redesign of an existing product but a completely new product, often based on a new technology. The examples below were the first commercial GPS devices. They focused at the time on the minimum added value of a GPS: your location.

As you will be exploring uncharted waters with this approach, you will be facing big risks. Only 15% of new products are successful. This isn’t necessary a problem, if you are aware of the type of journey you are undertaking.

Challenging: R&D vs. marketing

In a previous engineering job, I was continuously exploring new ways to achieve higher performances of the product. It was only a few years later that I discovered it was reliability, not performance, that needed to be changed. I thought I had to develop a Ferrari while the market was expecting a Volvo. A clear mismatch between engineering objectives and market needs.

Value engineering falls in between R&D and marketing. Both departments tend to push the responsibility to the other side, or are aware of each other’s goals. R&D says: “Added value? That’s the task of marketing, not on my budget.” While marketing says: “BOM cost? Not my responsibility (nor budget).”

In general, R&D receives cost and quality requirements but doesn’t have the tools nor insights on how these two are balanced when the requirements are not 100% clear (or in contradiction). Therefore a continuous cooperation between R&D, product management and marketing is crucial during the development of new products, in the front end as well as in the engineering phases.

I find therefore that “Value Engineering” is a perfectly chosen definition for what it stands: value is market, engineering is R&D, resulting in a mix of the two.

Small exercise

You reached the end of the article and you might be wondering if it was worth your time and if you found it interesting. Consider the “interesting” part as the value and your time spent as cost. Considering the equation interesting/time, would you consider the time spent as value for money?

Time is money.

From my perspective: considering the time I spent on the article, the experience of writing it all down, and how many people I reached with this article, would I consider this article as good value engineering exercise? Time will tell.

Download the perspective