A Flemish Green Deal, launched at the beginning of 2019, should bring the building industry towards a circular economy in Flanders. The partnership nurtures collaborations between manufacturers, builders, local and regional governments, researchers and building contractors.

The building sector has a vast impact on the total use of materials in Flanders and elsewhere: 25-30% of our waste origins in the building industry, not even half of this volume is reused, recycled, composted or digested. Moreover, the way we build and live has a huge impact on our carbon footprint. Obviously the size of the industry and total volume of materials used, make a change towards a circular economy undoubtedly very interesting. The value add from specialized construction activities that include renovation work and energy retrofits is estimated to exceed 283 million Euros annually. Recent studies show that 2,5 million jobs could be created with energy-friendly retrofit work by 2030 if we do it right1.

1 Europe’s energy transformation in the austerity trap – Marco Torregrossa

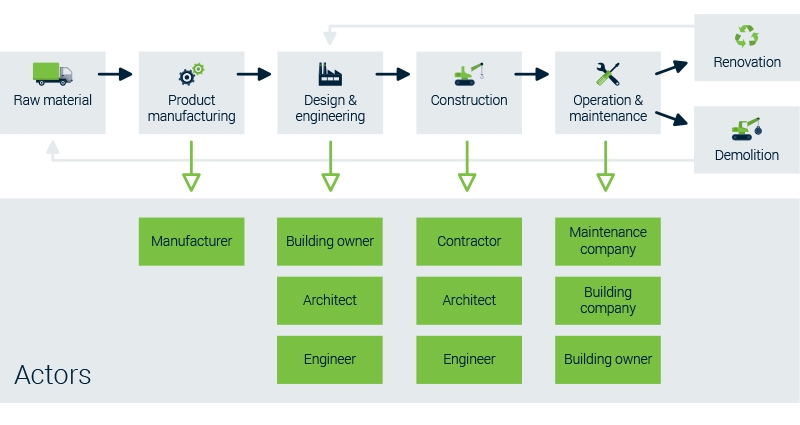

Furthermore, the building industry is a market were various sectors collaborate. It has the potential to embrace different value chains, especially because it is organized rather locally. The high level overview of traditional construction sector from a life cycle perspective shows conventional actors, hence it indicates the potential turnaround in value creation and value capture across different loosely coupled value chains. The interactions between actors in the process of the value chain are everything but linear, thus much more complex than one can depict.

Make a difference by getting your priorities right.

Analysis conducted by e.g. the Wuppertal Institute (EUFORES et al.2009) indicate that massive investments are needed in building retrofits each year. DG Clima (European Commission) figures 4,25 trillion Euros are needed for energy-efficiency investment across the economy between 2011 and 2050. Our climate goals set forward also demand an acceleration of renovation efforts in general and in Flanders more specifically. In Flanders we notice a quite substantial demand for advice in renovations and energy retrofits, hence the intention to rebuild with residential house owners is omnipresent. The actual retrofit level, however, does not keep pace with the intention because private house owners face some challenges in terms of sustainable renovation. Local authorities receive many requests for support or clarification on builder’s expertise or reliability, standard offers, cost prices, etc. We can also argue that the ‘new build’ segment faces a similar complexity. At the moment we notice a kind of market failure, or at least a market friction were market demand and market supply cannot or can only partially meet up.

Challenge 1: Consumers face scarcity at installers end

Besides builders we notice that the first point of contact for residential home owners is often an installer (plumber, roof worker, electrician …), but normal market mechanisms lack for 2 reasons. The first reason can be found in the fact that availability of these experts is unclear, you simply don’t know when they can or will do the job. The second reason is that there are not enough installers, market demand exceeds the supply. Multiple reasons are the basis of this deep rooted problem. Obviously Flanders, likewise the rest of Europe, faces scarcity of technical profiles, but subsequently this is amplified by the earning model of installers, which is in most cases still tied up to a margin on the goods delivered. Therefore installers seek jobs with an optimal balance between the value of goods delivered and the number of working hours. Renovation works, however, are pretty labor intensive which makes them less attractive from an economic viewpoint.

Challenge 2: Who’s the trusted adviser in the complex world of sustainable building systems?

We’ve noticed a steady trend of manufacturers delivering components step by step transforming into suppliers of elements and even system solutions combining building techniques, materials etc. Obviously complexity increases at a linear pace. HVAC, insulation, home automation, sun blinds, window glass, roof systems … are just a few elements that interact with each other in terms of in house temperature control. But who has knowledge on a system level of this complex subject? Consumers seek advice on how it works (together), what variants you could consider and when to choose for what particular option. Underlying we need to understand that the EU building sector is characterized by a high number of micro enterprises, mostly operating at local level. Enterprises with less than 9 employees represent 94% of all enterprises active in the sector, while large enterprises represent less than 1%.

In 2011, enterprises with less than 50 employees generated 72% of value added in the EU building sector, while those with more than 250 employees generated only 14%2. A different kind of contact across the retrofit value chain must be realized in order to come with on point advice. We believe manufacturers in the industry can redesign and shape the ecosystem in such a way it becomes attractive for many stakeholders.

2 Driving Transformational Change

Challenge 3: Sustainable retrofits demand new services

Sustainable retrofitting requires new ways of capturing the value in terms of new services and in terms of modus operandi. Retrofitters and manufacturers must deploy new kind of services to enforce the circular model even changing the deep rooted DNA of the current business models. While some look at products-as-a-service, others will make money with reusable materials. For the company ETAP we investigated light-as-a-service, hence anchoring value added services locally. Interesting, because these value add services are less prone for outsourcing in low-cost economies. Obviously the current design of the portfolio of lighting equipment leaped beyond this idea as well. A different earning model puts new requirements ahead for the products involved. This is one kind of an example, another one we find with the company Knauf that developed a hybrid dry wall board ‘New Horizon’. This specific wallboard starts with the service of dismantling used boards in buildings and refurbish them into a ‘New Horizon’ board. Knauf partnered with the Urban Mining Collective in Holland to mine used boards. Many materials, among other dry walls, have at the end of life of a building still a high quality. They could be recovered and applied in new buildings, if the service is designed in such a way it becomes attractive for building owners and the business model works for all stakeholders. New Horizon dismantling is done in a particular way to make sure Knauf can reuse a maximum amount of boards. Building elements gain a second life, important in this viewpoint is to understand the life time of a building is long. A massive reduction of carbon footprint can be shaped.

Challenge 4: Sustainable retrofitting demands smart logistics with plug and play solutions

Rather than looking at the building as a product per se, exploring its functions and how the different elements and materials provide this function is one of the keys to changing the mind-set of those involved in its construction, servicing, regulation, etc. Taking an end-use functional perspective (thermal comfort, shelter) allows to move one step away from traditional industrial sectors towards changing the way complex multi-sector value chains deliver services to end-use consumers. The service delivered by buildings (and by actors delivering building services) is associated to its end-use functions: provide shelter, thermal comfort and identity. The end-uses are closely related to the final energy consumption of a building. The factors responsible for this final energy consumption are the buildings envelope’s characteristics, the installations and the user behavior. These three factors all have a large impact on the building end-use functions such as comfort, performance of work, healthy indoor environment, ‘look & feel’ of the building, etc.

adapted from BPIE © VERHAERT

The building industry has not yet adopted holistic prefab construction systems yet, therefore the archaic on site construction is perceived as highly complex. Basically it’s bound to transform. System engineering will become the new normal in order to make sure standardized modular prefab systems fit a wide variety of end-use functionalities with lesser energy consumption and lesser carbon footprint. Smart design integrating digital technologies smartening both logistics and use of new products must be considered meticulously. They must facilitate a profitable delivery model. Otherwise no sustainable viable business can nourish.

In a circular building economy products and materials are designed in a way they use less carbon footprint, are reused as much as possible, comprise new earning models based on novel designed services to create and capture the value for those involved in the value chain. These new products, materials and services should also influence our behavior towards an energy efficient paradigm that is desirable for consumers, basically you and me.

Market uptake through inventive service and business design.

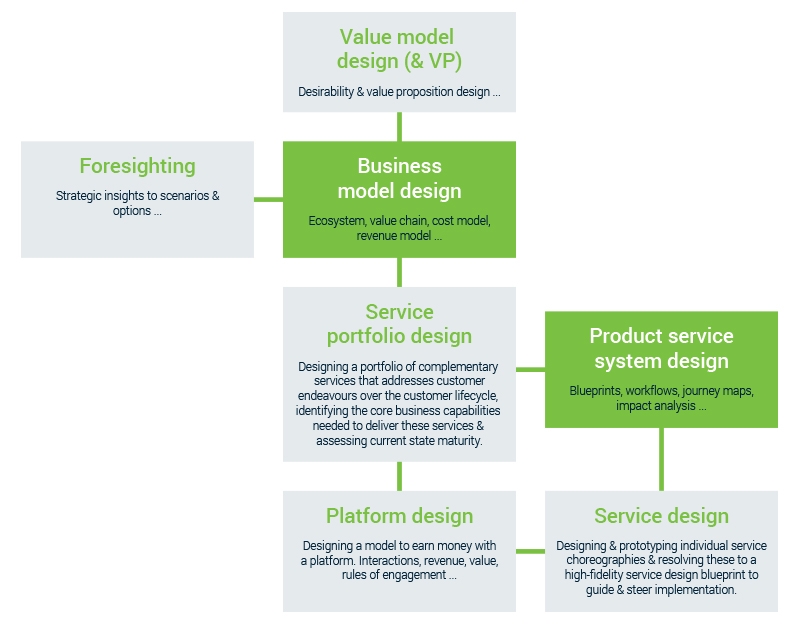

Industry transformation is a lengthy and complex process with a huge number of underlying dynamics. In order to navigate through the swamp of changing regulations, new product introductions and evolving market needs you require excellent foresighting skills; being the science of ability to predict what will be needed in the future. We notice organizations often lack them. With long term investments ahead transformational innovation can be very expensive, despite one can take small steps. Taking the wrong bet is not a good foresight for most shareholders.

Circular requires new business models and novel collaboration across the complex value chain. The business design effort should be focused on making a sustainable profit with a suite of circular services, supported by an intelligent earning model. The circular service portfolio should also comprise a platform function, with digital interactions and a platform business model providing incentives to all stakeholders involved. The current incentive model based margin and markups in the value chain will have to be reinvented. That’s not an easy challenge, but one which can be solved.

As early as 2006 Armstrong Ceilings took their first steps toward circular design principles by implementing an end-of life take-back program for their own mineral ceiling tiles. Across Europe Armstrong has now taken back over 500.000 m2 of old ceilings, including those of their competitors, and globally they have recycled over fifteen million square meters. But implementing a take-back program was not sufficient. Armstrong ensured that their products use materials that are safe, healthy and endlessly reusable as well as adopting manufacturing processes that minimized resource consumption including energy and water.

The Armstrong case provides an important lesson; the entire value proposition should be attractive to make use of, otherwise adoption will be slow or in some cases even be totally absent. The new services should be easy to use, safe to use and desirable to use. They have to be designed, just like any other conventional product to be desirable. Contextual inquiries, observations and other user centered design techniques lead the pathway to meaningful services having sustainable adoption and a high willingness to pay.

Obviously circular is also about the hardware. Smart designed products will become the new normal. But what is smart? Smart can be integrating digital, but smart has many executions. Carpet manufacture has been re-imagined by Niaga. According to Niaga (the word ‘again’ spelled backwards) adding more and more complex combinations of materials to everyday products will not solve today’s product performance, health and environmental challenges. That’s why they developed a carpet production technology to make carpets out of one material only, or two materials bound together with an adhesive that can decouple on demand. This allows carpet producing companies to sell or lease carpets that can be 100% recycled to new carpets after use. The core of the Niaga product design philosophy is to work with a drastically simplified set of known and pure materials. In effect, carpet producers cannot choose the cheapest possible material for different parts, like latex for glue, or bitumen for backing. This additional cost has to come with some financial benefits to make it work in the market place. These benefits present themselves over the full value chain, so they materialize differently in different countries. A keen platform business model supports the uptake across different value chains in several countries.

At the same time, disruptive innovators are adopting new business models using circular economy principles and transforming established markets with incredible speed. The application of circular economy to the building industry requires a systems-thinking approach, one which gives an understanding of the whole building life cycle and the construction value chain, or in other words, understanding the wider context in which development takes place. Only once the value chain is fully understood can the opportunities of the circular economy be realized. Even a small company can make advantage of this knowledge and benefit from it. That’s how small ones grow big time.

As Peter Drucker has noted, entrepreneurial management practices are fundamentally different from employee management practices, requiring large-scale transformation of our existing enterprises. The challenge is that top-down, big-bang approaches to organizational transformation rarely succeed. Instead, the most powerful way to achieve transformation is by scaling at the edge – a part of the company that today is relatively modest in terms of revenue and profit but which, because of the exponential forces at work in our economy and society, has the potential to grow into the new core of the company. Who can do all this? Why, entrepreneurs, of course. We notice many manufacturers with potential to transform, taking a modest risk, but lacking the ability to tie things together. Not a surprise entrepreneurs have become a product on their own. You can simply hire them to do a job.

Download the perspective

Looking for solutions to innovate?

Leave us your email and get in contact with Kevin Douven, Business Development Manager Consulting Office, to help you with your innovation process.